CREDIT RISK MANAGEMENT

1. The ultimate goal of Credit Accounts Receivable:

- A fine-tuned Accounts Receivable function is vitally important to the cash flow of a business

- To increase working capital

- To maximize company’s profit

2. The three basic processes that make up the accounts receivable function are:

- Credit Management -- including of credit policies, credit checks and approvals /Credit Process, and credit monitoring

- Collections Management -- Collection or A/R Management is a process starting from A/R maintenance, A/R Handling and A/R Recovery conditions, and so it is including methods to monitor and motivate internal and external collections agents, collections techniques, and technology.

- Remittance processing -- including payment methods and automated processing.

3. Credit Management Framework

CREDIT MANAGEMENT

2.1. CREDIT POLICY

Description of Proces Improvement (for Example)

2.2.1. Credit Scoring

Credit Scorecards are mathematical models which attempt to provide a quantitive measurement of the likelihood that a customer will display a defined behavior with respect to their current, or proposed, credit position with a lender.

2.2.2. Mobile Survey

Using technology of GPRS mobile phone to speed the process of survey in order to achieve of Company's Service Level Standard

2.2.3. Incentive Scheme

- Incentive from acquisition (Surveyor)

- Incentive from retention (amount collected)

2.2.4. Appropriate forms, tools, flow and rules

- Related to Credit Policy

2.2.5. Others

2.3. CREDIT/PORTFOLIO RISK MONITORING & ANALYSIS

Function of Credit/Portfolio Risk Monitoring & Analysis :

- To Identify Critical Few Portfolio Risk For The Product Line

- To Pre-Define Early Trigger Points That Will Flag The Need For Action

- To Pre-Define Early Warning Sign of Portfolio Risk Product or Credit /Collection Management

- To Proactively Plan On Actions To Mitigate Risk.

- The Most Critical Risk Drivers Identified At The Product Level

COLLECTION MANAGEMENT

Collection or A/R Management is a process starting from A/R maintenance, A/R Handling

and A/R Recovery conditions, and so it is expected that the A/R (account) quality can

Be maintained well and meet these 3 criteria:

-Have a good collectibility

-Low Overdue

-High recovery level

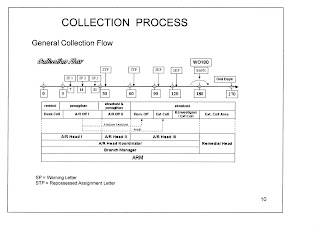

COLLECTION PROCESS

COLLECTION HANDLING

Overdue Activities process and PIC which commonly used by Multifinance / Credit company

1-3 days :

Activty : Phone Collection, doing by Desk Collection

4-13 days

Activity : Fileld Collection and Desk Collection, doing by Surveyor, Collector (AR Officer), & Desk Collector

• For first payment default (1 -14 days, 1 installment) :

- inform to surveyor to do field visit (resurvey)

- Field collection

• For first payment default ( > 14 days, 1 installment) :

- Field collection, issue warning letter & resurvey

- resurvey is to find that there is an internal deviation

or not

• For second and further installment, for customer overdue > 3 days :

- Do field and cash collection to customer

Activity : Field Collection, doing by Collector (A/R Officer) and A/R Administration

• Ensure the reason of default payment

• Send : - 1st Warning Letter (day 7)

- 2nd Warning Letter (day 14)

- 3rd Warning Letter

Warning Letter is automatically printed by system, all sent

& get receipt

22-30 days

Classified as “ Warning Zone”

Activity : Field Collection, doing by Collector

- Still doing Field Collection & Tracking

- Send latest warning letter (interval for warning letter is 7 days)

- Should identify the problem and prepare problem handling

action

31 -60 days

Activity : Repossession and Field Collection, doing by Remedial, Collector and A/R Admin

Classified as “Potential Bad Debt” Customer

- Ensure that that the latest warning letter has been received by customer

- If there is no payment and the goods/unit is still in the customer’s hand,

assignment letter for repossession (STP) is prepared & attached with

support documents

- Repossessed the goods / unit

- wait 7 days for customer redemption, if over 7 days

61 – 90 days

Activity : Remedial (by External Collector), cooperate with Police, Lawyer

In this bucket, usually goods/unit has been handed over, disappeared or insurance cases

- Assign remedial officer to monitor customer existence

- press the customer for still do installment paying & find the goods/unit

- using the debt collectors (external), Lawyer, or police for incooperative

customer

- Do Shock therapy (if needed) for incoperative customer customer, such as : Conduct lawsuit (custody the customer) with press charges of fraud

91-180 days

Usually in this bucket customer and goods/unit is disappeared & categorized as “potential Write Off customer”

- Coordinate with Debt Collectors, Investigation company or the police to

track the presence of the goods/unit

X > 180 days

- Coordinate with Debt Collectors, Investigation company or the police to

track the presence of the goods/unit

COLLECTION MONITORING / CONTROL

- Daily consistent monitoring and control activities. problems are mapped & alternative problem solution for collection & recovery should be planned

- Weekly consistent review for A/R Officer and remedial officer perfomance track

Monthly monitoring

COLLECTION STRATEGY

- A/R officer (Collector) & Remedial Officer officer is devided by area & by bucket

- A/R officer (Collector) & Remedial Officer should daily set a collection target. Visit target : minimum 8 customer, max. 12 customer a day

- At the end of the day (afternoon) or the latest the next morning day, all FC result should be reported to A/R Head, and all cash payment- sholud be deposited to teller. Visit result (collected payment or promise to pay) is then input the sysyem by A/R admin.

- Send WL1, WL 2 & WL 3 and STP to uncollected customer

RESCHEDULLING AND RESTRUCTURING INITIATIVE

Will be written separately

REPOSSESION & INVENTORY MANAGEMENT

Will be written separately

INCENTIVE SCHEME

will be discuss later

WRITE OFF POLICY

will be written latter

- By Fredy A. Nugroho -

1 comment:

Menarik pak.

Mungkin bisa diadakan seminar/training, saya yakin banyak yang berminat. saya earlybird deh.

salam kenal,

Jonny

Post a Comment